Naomi Klein - INTERVIEW 26 Oct 2008

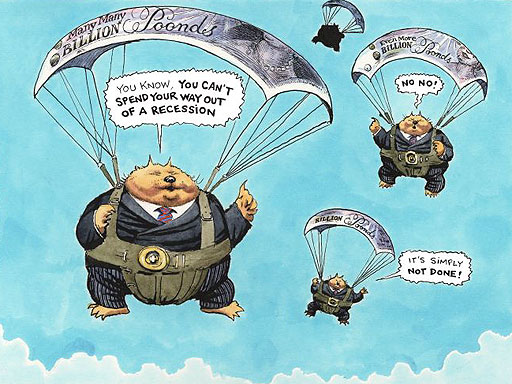

Maynard Keynes revisited..

The Nation. Posted October 31, 2008.

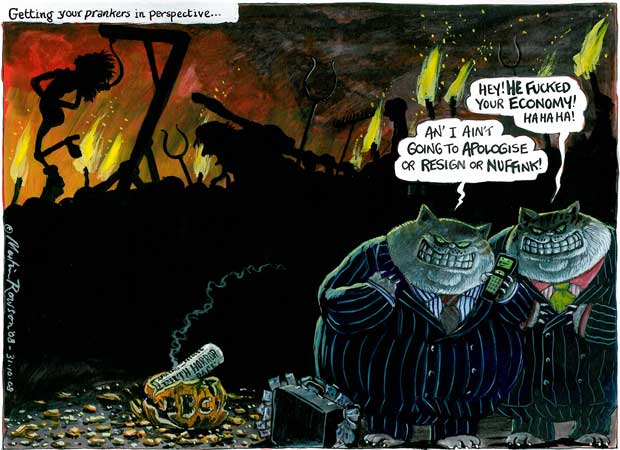

In the final days of the election, many Republicans seem to have given up the fight for power. But that doesn't mean they are relaxing. If you want to see real Republican elbow grease, check out the energy going into chucking great chunks of the $700 billion bailout out the door. At a recent Senate Banking Committee hearing, Republican Senator Bob Corker was fixated on this task, and with a clear deadline in mind: inauguration. "How much of it do you think may be actually spent by January 20 or so?" Corker asked Neel Kashkari, the 35-year-old former banker in charge of the bailout.

When European colonialists realized that they had no choice but to hand over power to the indigenous citizens, they would often turn their attention to stripping the local treasury of its gold and grabbing valuable livestock. If they were really nasty, like the Portuguese in Mozambique in the mid-1970s, they poured concrete down the elevator shafts.

The Bush gang prefers bureaucratic instruments: "distressed asset" auctions and the "equity purchase program." But make no mistake: the goal is the same as it was for the defeated Portuguese -- a final frantic looting of the public wealth before they hand over the keys to the safe.

How else to make sense of the bizarre decisions that have governed the allocation of the bailout money? When the Bush administration announced it would be injecting $250 billion into America's banks in exchange for equity, the plan was widely referred to as "partial nationalization" -- a radical measure required to get the banks lending again. In fact, there has been no nationalization, partial or otherwise. Taxpayers have gained no meaningful control, which is why the banks can spend their windfall as they wish (on bonuses, mergers, savings...) and the government is reduced to pleading that they use a portion of it for loans.

What, then, is the real purpose of the bailout? I fear it is something much more ambitious than a one-off gift to big business -- that this bailout has been designed to keep pillaging the Treasury for years to come. Remember, the main concern among big market players, particularly banks, is not the lack of credit but their battered share prices. Investors have lost confidence in the banks' honesty, and with good reason. This is where Treasury's equity pays off big time.

By purchasing stakes in these institutions, Treasury is sending a signal to the market that they are a safe bet. Why safe? Because the government won't be able to afford to let them fail. If these companies get themselves into trouble, investors can assume that the government will keep finding more cash, since allowing them to go down would mean losing its initial equity investments (just look at AIG). That tethering of the public interest to private companies is the real purpose of the bailout plan: Treasury Secretary Henry Paulson is handing all the companies that are admitted to the program -- a number potentially in the thousands -- an implicit Treasury Department guarantee. To skittish investors looking for safe places to park their money, these equity deals will be even more comforting than a Triple-A rating from Moody's.

Insurance like that is priceless. But for the banks, the best part is that the government is paying them -- in some cases billions of dollars -- to accept its seal of approval. For taxpayers, on the other hand, this entire plan is extremely risky, and may well cost significantly more than Paulson's original idea of buying up $700 billion in toxic debts. Now taxpayers aren't just on the hook for the debts but, arguably, for the fate of every corporation that sells them equity.

Interestingly, Fannie Mae and Freddie Mac both enjoyed this kind of unspoken guarantee. For decades the market understood that, since these private players were enmeshed with the government, Uncle Sam would always save the day. It was the worst of all worlds. Not only were profits privatized while risks were socialized but the implicit government backing created powerful incentives for reckless investments.

Now, with the new equity purchase program, Paulson has taken the discredited Fannie and Freddie model and applied it to a huge swath of the private banking industry. And once again, there is no reason to shy away from risky bets -- especially since Treasury has not required the banks to give up high-risk financial instruments in exchange for taxpayer dollars.

To further boost confidence, the federal government has also unveiled unlimited public guarantees for many bank deposit accounts. Oh, and as if this wasn't enough, Treasury has been encouraging the banks to merge with one another, ensuring that the only institutions left standing will be "too big to fail." In three different ways, the market is being told loud and clear that Washington will not allow the country's financial institutions to bear the consequences of their behavior. This may well be Bush's most creative innovation: no-risk capitalism.

There is a glimmer of hope. In answer to Senator Corker's question, Treasury is indeed having trouble dispersing the bailout funds. It has requested about $350 billion of the $700 billion, but most of this hasn't yet made it out the door. Meanwhile, every day it becomes clearer that the bailout was sold on false pretenses. It was never about getting loans flowing. It was always about turning the state into a giant insurance agency for Wall Street -- a safety net for the people who need it least, subsidized by the people who need it most.

This grotesque duplicity is an opportunity. Whoever wins the election on November 4 will have enormous moral authority. It can be used to call for a freeze on the dispersal of bailout funds -- not after the inauguration, but right away. All deals should be renegotiated immediately, this time with the public getting the guarantees.

It is risky, of course, to interrupt the bailout. The market won't like it. Nothing could be riskier, however, than allowing the Bush gang their parting gift to big business -- the gift that will keep on taking.

Klein: Naomi Here.

Kall: Oh, Great. And I just used the word "shock," too. Great to have you here, so much. I was just talking about how Hank Paulson pulled together the leaders of the top banks in the country on Monday and they simply sat them down, told them how bad things were, handed them a document, then said, "This is what you're going to agree to. Did you see that article in the Wall Street Journal?

Klein: I saw the article, but I think the way this is being spun is a little absurd.

Kall: Well, tell me about it.

Klein: Well, the spin is that Paulson was really tough with the banks and forced them to sign against their will; I mean the terms of the deal are incredibly favorable to the banks; they didn't have to negotiate, because they couldn't have negotiated a better deal for themselves. They get the money but the government is taking no power, there's no voting right, so they've just been handed free money in the midst of an economic crisis; a lot of these banks, if they are not bailed out, they're going down. So this spin that Henry Paulson is so tough with the banks is absurd; he's the best thing that's ever happened to them, and he's one of them.

Kall: Now Ben Bernake studied the Depression and during the Depression, they did something like this but the government did have control, isn't that right?

Klein: Exactly; and even if we just compare what Paulson did to what Paul Brown did, just on the straight level of what taxpayers are going to get paid back Gordon Brown and British taxpayers are getting 12% and American taxpayers are getting 5%.

Kall: Woo!

Klein: They could have gotten a much better deal, so no wonder the banks agreed to it so quickly.

Kall: I'd love to hear more about what you've been observing and what's been going on the last couple of weeks. The bailout, the consolidation of all these banks-- fewer and fewer.

Klein: Well, it's been an interesting couple of weeks; I think that people need to take all this media reporting with a great deal of skepticism; one of the real lessons, I think of this period, and you know this is a period of shock. As you know, one of those moments where things start moving into "fast forward"; there's so much that happens in a week, you can't even keep track—

Kall: Let's just take one moment; I introduced you before you got on, 'cause I didn't want to waste any time, but you've written a book, The Shock Doctrine: Disaster Capitalism; can you give just a few minutes to get us a quick overview of what it is and how that fits into what we'll be talking about?

Klein: Yes, well, the thesis of the book is that if we want to understand how this radical "market fundamentalism" has swept the globe, the system that has imploded before our eyes, the de-regulated system that has been so profitable for the people at the top but something of a disaster for everyone else.

If we want to understand how this system has swept the globe from Latin America to Russia to this country, we need to understand the incredible "utility of crisis" to this project, because the great leaps forward for this project have taken place in the midst, during the immediate aftermath of some kind of a shock.

The extreme cases that I discuss in the book are wars, terrorist attacks, natural disasters, but overwhelmingly, the most common shocks that have created the context for pushing through these very unpopular policies in a way that economists often call "economic shock therapy," the first shock is the economic crisis, the second shock is the economic shock therapy; overwhelmingly the shocks have been economic crises, whether it's the Asian financial crisis in 1987 or the economic crisis in the former Soviet Union that created this sort of panic atmosphere where they could impose economic shock therapy, so we are in one of those moments of shock.

In the book, I quote a Polish human rights activist in 1989 describing what it was like in that country when they were living through a very profound economic crisis. They became the first Eastern Bloc country to be prescribed shock therapy, and as she said, "We're living in 'dog years' (laughs) not human years, which is to say it's this fast forward intense period where you can barely keep up and I think we are living in dog years at the moment.

Kall: You know, one thing that shocked me, and I've got to ask you this: ever since I read Sinclair Lewis's book, It Can't Happen Here-- have you read that?

Klein: Yes.

Kall: It's fascinated me, and I followed how we've been moving in that direction.

Klein: Yes.

Kall: Well, recently, I got a first edition with the dust jacket and it's very similar to the cover of your book. Are you aware of that?

Klein: I had no idea.

Kall: I'm going to send you a picture of it; it'll blow your mind.

*** PICTURE OF covers of Shock Doctrine and Lewis's 1935 IT CAN'T HAPPEN HERE

Klein: Great!

Kall: In many ways, "The Shock Doctrine" recaps what happens—it can easily, it's happened; that's what happens it can't happen here. Right?

Klein: Yeah, and I think that one of the things, just coming back to the beginning of our discussion, thinking about what we've gone through in the last few weeks is that this tactic of using a crisis to push through very unpopular policies really relies on people not knowing about it. It is a tactic that is about harnessing the state of panic, the state of disorientation, even the regression that takes place in a crisis; but there is a kind of law of diminishing returns on this particular tactic, because once we've identified it, then we engage in a kind of a pattern recognition once it gets reused.

But one of the lessons that it's really important to focus on, if we think about the original bailout plan, the Paulson Plan-- that two and a half page extraordinary document that Hank Paulson came up with, giving him absolute power, shielding his plan to buy 700 billion dollars of toxic debt from challenge from any arm of the government, or any court--there was a real popular uprising against that plan and people just didn't buy it, despite the fact that the big corporate media was selling it really hard, like saying, you know, "We're all going to die unless we get this plan and this isn't a bailout for Wall Street, it's a bailout for you and it's the only option."

And there was, you know, bipartisan support for this thing and both candidates signed on to it and Congress voted against it; Congress voted against it, originally; we know they voted for it eventually, because Congress people were being bombarded with calls from their constituents saying that they didn't want to bail out Wall Street, that they didn't believe that this plan would help; they didn't believe it would benefit them. We know that the Congress people who were in the tightest races were more inclined to vote against the plan. So it was an outbreak of real democracy (laughs) in the United States.

After that, people were really scolded, right?--For their "ignorance" for having turned away from this bailout that would've saved them, and eventually the Senate approved it and Congress approved it with some amendments.

What's important about where we are now is that we see that the people were right, despite the fact that they were hearing from everybody how wrong they were, that original assessment that this deal stank, that there was something wrong with it was the right one and more than that, people remembered the patterns: they remembered what happened after 9/11; they remembered the way they were sold lies in the lead-up to the war in Iraq, so I think the people are becoming more shock resistant, but unfortunately, the political leadership is doing everything that they can to resist back.

Kall: Well, yes, and that is the problem, isn't it? Do you think they get this? As soon as this broke, the first thing I did was talk about how this was another example of selling WMD, why selling WMD was a way to scare everybody. But--

Klein: In this case, they really are WMDs, right? I mean these toxic debts are often described by economists as like sticks of dynamite in these financial institutions they really are bombs that Henry Paulson is voluntarily taking from the financial sector and bringing to Washington so that they can explode the federal budget. And it may well save the banks and it may well bankrupt the country. These are the stakes and at a certain point the question is: them or us?

Kall: And it seems like they are not finished doing the damage yet. After a day like today we can expect a lot more roller coaster rides, going down and down, further and further.

Klein: There is one good thing that came out of the wrangling and the negotiation, which was a clause that gave Henry Paulson the ability (though it didn't mandate him), the ability to buy equity in the banks and now that clause is being invoked. They are not abandoning, and this is very important for people to understand: they are not abandoning the original terrible plan of buying up the toxic debt; they're just doing both, OK? They're contracting out the job of buying up the toxic debt to the same banks that are applying for the bailout and the levels of conflict of interest, I've been looking at the contracts and who they are being handed out to, I mean it just makes your hair fall out; the shamelessness is unbelievable. The law firm that has been given the contract to advise the government on the equ9ity buyout is the law firm for seven of the nine banks. (laughs) OK?

Kall: Oh, my God; what a conflict of interest.

Klein: Right, but I guess it's hard to top Henry Paulson himself, right? Known as "Mr. Risk" when he was CEO of Goldman Sachs, was one of the inventors of this field of very complex mortgage backed securities and he took Goldman Sachs' debt from 20 billion dollars in 1999 to 100 billion dollars in 2005. So he's one of the people who put those explosives in the bank and now he's taking the explosives off their hands. So I guess once you've accepted that level of conflict of interest, the rest is—minor.

Kall: What do you think of Paulson's appointee, this Neel Kashari?

Any ideas about him?

Klein: Well, he's also from Goldman Sachs and he's very inexperienced; he got his MBA six years ago; he was certainly favored at Goldman Sachs; he was paid $700,000 in his final year. What worries me about him is that he comes out of that world, and he's going back to that world, right? I mean, this is a very short term job for him. He is a political appointment and he will be out of there.

Kall: In a couple of months.

Klein: In a couple of months. And I think that really does raise the question of where his interests lie. I mean they are saying over and over again, "We are only interested in what's good for taxpayers, but as I said, you know, Gordon Brown got a deal for British taxpayers that's you know, more than twice as good.

Kall: 'I haven't heard that reported, anywhere.

Klein: You know what; I read it in Financial Times, OK? In an editorial in the Financial Times today they remarked on that. But the point is that there is still an election; politicians are still open to pressure so they have taken a step in the right direction in going for equity, but the deal has to be much better and it has to be power as well as risk that is transferred to the taxpayer.

So people need to stay engaged in this debate, because as you say, this crisis isn't ending and the stakes couldn't be higher. Anyone who cares about the promises that Barack Obama is making and his ability to make good on those promises, has to care about whether the Bush administration is currently in the process of bankrupting the next administration because the people who are selling this plan right now will go back to their think tanks after the election, if Barack Obama wins, and then—this is interesting, you know, Henry Paulson in a statement yesterday started talking about the financial crises and needing to re-examine entitlements. That's code for Social Security, Medicaid, right?—I mean they're already getting ready to go after what they call the entitlements programs. Which I find amazing even that phrase "Entitlement Programs" after seeing the sense of entitlement (laughs) from the financial industry it's pretty amazing.

But they will use the crisis that they themselves have created and they themselves have deepened as a rationale for saying everything Barack Obama is saying "Yes, we can," about is saying "No, you can't, we can't afford it; we're in the midst of a financial crisis."

Kall: Now, what you said earlier about "Dog Years," about how things are accelerated--are sped up; people are used to calling their legislators once a month—

Klein: Yes.

Kall: something like that; the way things are going, they've got to be calling 'em every couple of days really it sounds like.

Klein: Absolutely! Absolutely. And I'll tell you something; I've heard from people in the Obama campaign that the day after Barack Obama voted for the bailout he got more negative calls than he'd gotten the entire campaign...

Kall: Good! He should have; he deserved them.

Klein: But listen, this is all connected and in terms of what the stakes are--these banks were going down, these banks were going bankrupt because of their own deeds; but as we know, the bankers themselves have golden parachutes and bonuses and so on, but it is possible to get so much of a better deal than the one that has been "negotiated" by Henry Paulson and Neel Kashkari of Goldman Sachs, OK?

The point of negotiating that deal is that these banks that have failed in the private sector are having to move in to the public sector; they are being nationalized but the question is, is it going to be a good enough deal that they will actually be serious revenue generators, because this could end up being a backwards opportunity. Being in a financial crisis and actually having a new revenue stream, a significant new revenue stream, which are the banks—frankly, it they are well managed, can be a serious source of revenue—could be the way that Barack Obama could pay for the promises he is making now.

I realize that sounds like something radical to say: "Nationalize the banks and use the revenue to pay for your (government) services." But I don't think that's more radical than what they're doing now. They are doing socialism for the rich and I think, if we're going to be nationalizing the banks, nationalize them in the interest of everyone, nationalize them in a way that will make this country be able to afford a real green energy infrastructure. Nationalize them in a way that will allow the United States to provide healthcare to every person in the country. That is what people actually should be demanding in this moment of Dog Years when things are moving so quickly and suddenly we don't know what's possible, think BIG.

Kall: You cite Milton Friedman, who was the father of this idea, kind of like Hitler was the father of Nazi-ism and I'm saying that, not you,

(unintell).

You spoke recently at the University of Chicago and you cited a quote that you use frequently, that Friedman said, "Only a crisis actually perceived produces real change; when that crisis occurs the actions that are taken depend on the ideas that are 'lying around'. That I believe is the basic function to develop alternatives to existing policy to keep them alive and available until the politically impossible becomes politically inevitable. Now, we have to be able to be ready with those ideas..."

Klein: Exactly.

Kall: Like you just described. And, does anybody have them? I mean, you noted in your book that you’ve been observing and collecting these Friedman-type lying-around ideas. Does the left have lying around ideas that they can plug in during this crisis...

Klein: Well, I think it does, yeah.

Kall: And step all over Paulson?

Klein: Well, I think that we do have those ideas and what we lack more than ideas is confidence in those ideas. And believing that they really are good ideas. Um...

Kall: And confidence to promote them.

Klein: Yeah, the confidence to promote them, especially in a crisis when they’re needed the most, right, on the verge of recession, really believe in that green infrastructure, you know, green collar economy that Van Jones is talking about. And use this moment to make it happen. Believe that you spend your way out of a recession. And believe that the global climate crisis is a bigger crisis than what’s going on on Wall Street. And that we cannot allow Wall Street’s crisis to cancel out our ability and take away our tools to meet the most pressing crisis of our time, which is global warming.

Kall: Uh-huh.

Klein: We need to stay focused. And, you know, I believe that that sort of confidence in this moment opens up tremendous possibilities. You know, if you can bail out AIG, an insurance company, which has now received more than a hundred billion dollars, right? That could get healthcare to every child in the country. And it’s time to seize this moment. Because, if we don’t seize this moment to make those types of arguments about what’s possible, right, and understand the stakes of actually negotiating a good deal with these banks, right? I mean, I think the banks should be allowed to go bankrupt and they should be taken over by the state on the most favorable terms possible.

And then they become the revenue generation stream rather than a sap on public resources that prevent us from meeting the climate crisis, for meeting healthcare crisis, and all of the other challenges before us. So this can be flipped into an opportunity, but only if there is tremendous confidence in our ideas. I don’t think it’s about not having the ideas, I really think the Left panics in a crisis, okay? And we regress and we start projecting far more competence and goodwill onto the people in the Bush Administration than they deserve. I don’t think that Henry Paulson has gotten nearly a rough enough ride. And we’re seeing this now from Barney Frank. He’s looking at these contracts and giving his seal of approval to the conflicts of interest. It’s outrageous.

Kall: Barney Frank represents all the bankers and all the investors in Connecticut. He’s doing his job. They’re his constituents, unfortunately for the rest of us.

Klein: Well, for the few weeks until the election, politicians can’t afford to ignore their other constituents. You know, and it gets harder after an election. And another point that I want to make to Obama supporters out there, which is: You know, he is saying some really important things out there on the campaign trail about this really being a referendum on an ideology, the ideology of deregulation and trickle-down economics, and that’s exactly the right message. What worries me is that he’s taking top-level economic advice from Bob Rubin and Larry Summers, both of whom are responsible, along with Alan Greenspan and Phil Gramm, for the disaster that we are living through right now. And I say that, you know, directly responsible. These are the people who refused to regulate derivatives, who fought off all attempts and sage advice saying that they should do so. There was a fantastic piece in the New York Times recently reexamining Alan Greenspan’s legacy. I’m sure you saw it, right? But what was really remarkable about that piece is that the two other people that really share the responsibility were Robert Rubin and Larry Summers. And what we know about Robert Rubin is that when he was at Goldman Sachs and after Bill Clinton won the election in 1992, he started having meetings with Clinton. This is after the election, but before inauguration. And, in that key period, he convinced Clinton that he should abandon many of his promises from the campaign trail and embrace economic austerity. Okay? We need to get Rubin away from Obama. He should be as much of a political liability...

Kall: Who is...?

Klein: ...as Reverend Wright. Because he is one of the people who created this disaster.

Kall: Who should Obama be listening to? Who are the good guys?

Klein: Who are the good guys? Well, Joseph Stiglitz is a good guy. And he is listening to Joseph Stiglitz. But, you know what? What we need to understand, right, is that he’s going to be picking his Treasury Secretary, he’s going to be picking his Trade Representative, he’s going to be deciding who’s going to replace Neel Kashkari and we need to make sure that it isn’t Rubin’s protégé, Jason Furman, who Obama appointed as an Economic Advisor, who is a believer in Rubinomics, and thinks Wal-Mart is great for poor people. It should be people like Stiglitz, it should be people like Paul Krugman, Dean Baker, Gerard Bernstein, and, you know, if he really believes that this is about abandoning these policies of deregulation, he needs to get away from Bob Rubin and Larry Summers.

Kall: How bad would things be, I mean...

Klein: I think one of the things people should say at this point to Obama, is that the next Treasury Secretary shouldn’t come from Wall Street.

Kall: Amen. I need to do a quick station ID. This is the Rob Kall Bottom Up Show WNJC1360 and I’m talking to Naomi Klein, author of The Shock Doctrine and, by my reckoning, one of the smartest people in the World. And I’m loving this conversation! Now, what can we do to get rid of Rubin and his ilk from the Obama Administration before it starts?

Klein: Well, we tell Obama that we agree with what he’s saying, but that we understand the game he’s playing. Okay? When he says this is the end of the ethos of trickle-down economics and deregulation and then he has his picture taken next to Bob Rubin and Larry Summers and Paul Voelker. You know what he’s doing? He’s winking at Wall Street. And he’s saying, “Don’t’ listen to what I’m saying to get elected, there’s going to be economic continuity, as the economists call it. And, you know, this is the game. Right?

Kall: This is why a lot of our readers don’t trust Obama and they’re not going to vote for him, actually, at OpEdNews.

Klein: You know what? I don’t think this is about whether or not you vote for Obama. This is about whether we understand the game. Okay? That’s the game he’s playing. And we also know that he’s vulnerable to political pressure. And we need to make Rubin and Furman and Summers political liabilities for him. We need to take him at his word. If he really wants to put this ideology on trial, then that includes people within the Democratic Party who created this disaster. I mean, so many of the policies that really directly created this disaster were introduced in the late '90s under Clinton. Okay? And it really doesn’t serve anybody to see this through a partisan lens. It was the killing of Glass-Steagall that put up a firewall between investment banks and consumer banks and it was the decision not to regulate derivatives. And those things happened in ’99.

Kall: Now, we’ve got about ten minutes left based on the time frame you’ve given me, and there’s two things I want to talk about yet. One, I call the show “The Bottom Up Show" because bottom up is the future of government, of Democracy, of elections. In the last couple weeks Bill Clinton and Obama have mentioned it. Could you kind of plug in some of your ideas into the bottom-up versus top-down way of looking at things? And then the other thing I want to talk about is McCain and how he’ll approach this.

Klein: Yeah. Well, I mean, this is why I say it’s not about how you vote for or who you trust. It’s about being a political adult and realizing that political change isn’t handed down from above; it’s demanded from below. And if we don’t, you know, what I’ve been saying to people is, look, you know, Obama’s a centrist. He’s never lied about this. This is who he is through and through. He will find the center of wherever that debate is. But, the good part about Obama is that if the center moves, he’ll move with it, and we’ve seen that during this economic crisis. Right? Where the center has moved, the base has gotten more and more radical, more and more angry at Wall Street, and Obama has reflected that anger back to people. Right? So, what I’ve been saying to people is, if you don’t like where Obama is, move the center. Move the center. Go out there and say some really radical things and fight for them and organize.

Move the center, because that’s how America got The New Deal. Not because FDR handed it down from above, but because people were organizing in trade unions, in neighborhood groups. They were preventing their neighbors from being evicted from their homes by moving their furniture back into their homes. That’s how things like rent control were won. That’s why Fannie Mae was created in the first place-to prevent foreclosures.

That’s how Social Security was won. It was in that interplay between a very, very mobilized, radicalized base and a politician who was willing to listen. And, but more importantly, FDR was able to sell The New Deal as a compromise. Because people were so radical that he was able to say to the elite, look, we’re on the verge of revolution, we’re on the verge of Socialism. We need to give them something.

And The New Deal, as we know, wasn’t just one policy; they had to deepen it and sweeten the pot, more and more because people were so radical. That’s the kind of spirit that we need to return to. So it isn’t about bashing Obama, or, you know, complaining about Obama, you know, or distrusting Obama. It’s about seeing that credible threat from both below.

Kall: So what do we need to ask for that they can compromise to? In other words, we...

Klein: Well, personally I’m asking...

Kall: In other words, we...

Klein ...personally, ah, you know, you just heard me call for the full nationalization of the banks. I’ve also been calling for the nationalization of Exxon. You know, when people say, you know, we won’t be able to afford the green energy plan, you know the biggest corporate criminals are not the banks, they’re the oil and gas companies. They’ve externalized their risk, which is climate change, and they’ve, you know, you’ve got a company like Exxon, which earns earned $40 Billion dollars in profits alone last year. I don’t accept the fact that while oil companies are earning that level of profit, that we’re going to be told that we can’t afford the investments in alternative energy and regulation that are necessary to address the most pressing crisis of our time.

So, you know, I’m going-- I’ve said this on National Television and I’m going to keep saying it and I think that that creates a space for a pretty deep windfall profit tax on the oil companies and, you know, it puts the discussion, I think in the direction where it should be.

But, you know, I think that there’s a feeling, there’s often a feeling, on the left in the United States where people are told that they’re a liability if they take too radical a position and there’s always this idea that you just sort of support the candidate until after the election, but then after the election the candidate’s going to be under a huge amount of attack from the right, so you have to support them against that.

So then there’s really never a moment of intellectual honesty. And I think this is, you know, I think this is a real test. I wish MoveOn would use their incredible network to say, you know, “We don’t want Bob Rubin." And really stand up for homeowners. And, you know, the networks are there, but there’s a real unwillingness to take these risks.

Kall: Well, what else can we do? We can privatize Exxon, what else? What other ideas...

Klein: Nationalize Exxon.

Kall: Nationalize, yes. What else can activists do, what else can the grassroots start doing now, immediately, to help move the Congress, move Obama to a better place that’s going to prevent the disaster capitalism from running rampant over us?

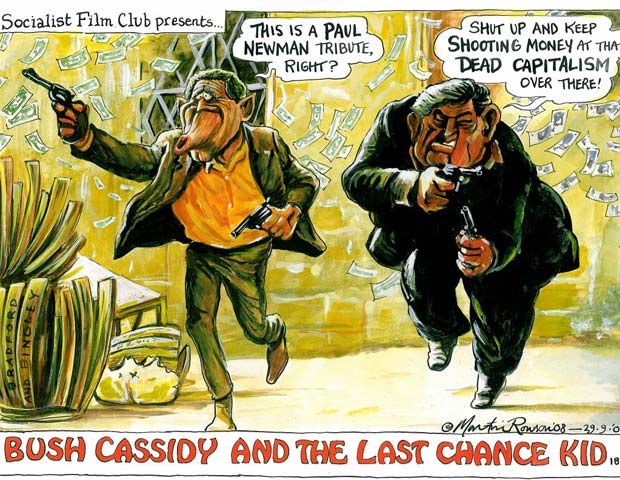

Bush Cassidy and the Last Chance Kid

Klein: Hmmmm-hmmmm. Well there, like I said, there is this window now where the terms of the bailout are being discussed. And it’s a really, really important window and unfortunately it’s also the most important window for the election. So everybody, you know, who is an Obama supporter is focused on, you know, getting out the vote and this final push and meanwhile, the terms of the bailout are being negotiated. And this is going to radically affect the room that Obama has to maneuver. So, there has to be some time spared for putting political pressure on that negotiation.

And one key demand is that, now that they have moved partially to the nationalization, as opposed to buying the toxic debt, the real issue is how much of the money is going to be spent on the toxic debt versus this other root and we really need to minimize the amount that’s spent on these toxic debts. Because this is just a bad plan, a discredited plan. The Bush Administration with their usual stubbornness won’t let go. The other thing is...

Kall: All right, so...

Klein: Yes.

Kall: So, so, we’ve got people who want to do something. They’re going to take time out from doing canvassing and phone-banking. They’re going to call their legislators. What are they going to tell them? What should they say?

Klein: They’re going to say...

Kall: What are their next phone calls?

Klein: Abandon the original plan completely. This is just, you know, at this point, this is just pride and cronyism that it’s still alive. There, there have...Every economist, every, even the conservative Wall Street Journal and FT Editorial Page has said that the equity plan is a far better plan than the toxic debt. Now why are they spending hundreds of billions of dollars buying these toxic debts still? They should abandon that plan along with the crony contracts that they’re handing out to administer the plan.

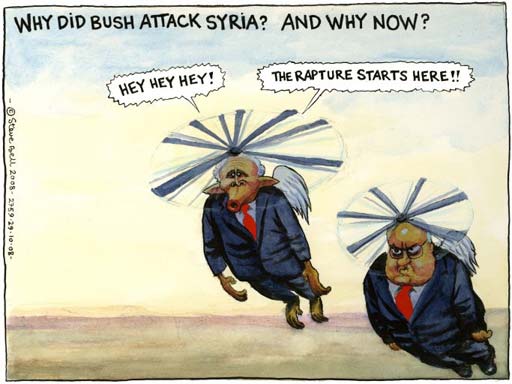

Kall: Okay, now, the last thing I want to rap with you on is I want to talk a little bit about John McCain and his approach to economics. What you said at the Chicago School was that his inexperience plays into the Friedman shock doctrine economic approach. Talk a little bit about McCain and Palin and where you see them going with economic approaches.

Klein: Look, I mean, we’ve been talking about what the right strategy would be if Obama wins. And one way I think that we can think about this economic crisis is that it’s sort of Republicans buying insurance against an Obama Presidency. And so they are able to say, “NO you can’t" about all the things that he’s saying “Yes We Can." Now they don’t need insurance against a McCain Presidency because it’s in McCain’s platform that he wants to privatize Social Security. He’s already saying that he’s going to freeze spending. He’s already saying that he’s going to look at every single government program and, if it isn’t working, either reform it or shut it down. So he’s really talking about a shock therapy program after he’s elected and you know, I think if he is elected, which is a terrifying prospect, I think he really will do it because, you know, there is unfinished business from the Bush years. Most notably, the privatization of Social Security...

Kall: You’ve gotten one of those Clinton words- “it." What is it that he will do; you said he will really do “it."

Klein: Do “it." That he really will eliminate all kinds of important programs and really will privatize Social Security because there is a window of opportunity after an election win where a politician has a mandate and they are able to do things very, very quickly, particularly if they can appeal to an economic crisis. So, I think that that’s precisely what they will do. And, you know, I guess what I said at the University of Chicago is that the appeal of this free market ideology, the Friedmanite Market Ideology, is that it says to politicians who are in over their heads when it comes to economics, that actually all they need to do is to get out of the way and let the market work it’s magic. Right?

So the fact that Obama - sorry - the fact that McCain admits that he doesn't know anything about the economy, and went ahead and chose a running mate, who knows even less - actually makes him much more inclined to embracing the very simple - it's really not an ideology, it's a series of talking points that the government is the problem and not the solution and so on - so basically it's an abdication of his responsibility to govern and I think that's why this ideology has carried so much appeal - for you know - not to be too snide - but you know - some actor presidents, bodybuilder Governor's and so on.

Kall: McCain also has Phil Gramm to appoint as the Treasury Secretary, right?

Klein: Yeah, and Phil Gramm made it his mission to get the, to get a medal of honor for Milton Friedman before he died. So he's a - Yeah, - he's very much a believer in this ideology but I don't think - for guys like him that it is really the ideology that drives it - I mean this is an ideology that is a gift to business - so you know what's driving it, is it that this is an incredible way to keep your donors happy - keep yourself in power or because you really believe that this is the best way to organize society? The beauty of the free market ideology is that you don't have to choose between self-interest and true belief - they're the same thing.

Kall: Amazing - Naomi Klein, author of Shock Doctrine. You said you had to go, do you have any time left or is it time to leave?

Klein: Yeah, unfortunately I have to go, Yeah, but it's been great talking with you

Kall: One last question. when I asked you about coming on, if you knew OP-Ed news you said Aof course@

Klein: Yeah,

Kall: Do you have any comment on Op-Ed news?

Klein: I think you guys are fantastic, and Yeah, I read you all the time and I appreciate the non-partisan nature of it and it's going to be more and more important - to have - to have real critical alternative voices that aren't lined up behind a candidate.

Kall: Thank you so much

Klein: Thank you

Kall: My pleasure - and I hope we can do it again

Klein: Absolutely take care - Bye

Kall: Naomi Klein - telling us that we've got to get on Obama. Telling us that we need to be calling a lot more than we're used to because things have sped up - we are in dog years - and a lot of people are telling us it's going to get a lot worse - and now it's a good time for some phone-ins. So...let's get some phone numbers here. This is going to take me a minute, but I'm going to give you some phone numbers to call in on and maybe we can get some folks to discuss this...I never have it handy, I've got to dig it up. just going to take a second. this is Rob Kall the bottom-up show 1360 AM WNJC and...

You want to call in - I'm going to give a couple numbers and my producer is going to correct me if I'm wrong - 856-232-7077 and 856-232-7078

Those are the two main numbers - 856-232-7077 and 856-232-7078 This is the Rob Kall show and we just finished talking with Naomi Klein and I've got to tell you, over the years I've run conferences for brain surgeons, brain researchers, NASA engineers - I'm impressed. This...Naomi Klein is 38 years old and I checked with...and I swear she's one of the smartest people I've ever met and I've met some geniuses. Boy - I'm impressed. I'm acting silly I think, but... she's something else. What this tells me is this is all a big plan, and it's all going perfectly - according to plans. This is something that didn't just accidentally happen. It happened because it was envisioned because there were theories and they were put into place. And now, we're going through the shock - we are going through the disaster that was envisioned by Milton Friedman and the Chicago school of economics.

Let me repeat that again - ATHE Chicago School of Economics.@ Now the University of Chicago is an incredible institution. The Chicago school of economics is part of the University of Chicago. The Chicago school of economics is an evil place - It is an evil organization that has perpetrated acts throughout the world that have led to many deaths, many tortures, much suffering. Attacks upon and destruction of democracy. The ends of unions - this is what Naomi Klein writes about in her book. This is the Chicago school of economics and she was speaking there because it had recently just established an Institute there...It's a uh $200,000,000.00 (two hundred million) dollars it's funded with. This is to promote Friedman's policies - Milton Friedman - these policies of the Shock Doctrine. Now what Naomi Klein didn't talk about, was she starts her book off talking about torture. It's not exactly torture, she actually starts off talking about research that was done in Montréal at Nadeau University by a psychiatrist, where he - he drugged people - he put them into sensory deprivation. They couldn't move, they couldn't feel. They would have like outfits on that would prevent them from feeling anything but the felt ..inside the outfit ...they would be kept in the dark. They would be disoriented and drugged and what they learned from this was they could get people to do almost anything, to believe almost anything, to agree to anything. And they figured this out that this was a nice way to work with prisoners - to get them to co-operate. So they transferred the concept to - torture. They transfer the concept of torture and the U.S. took this idea - this AShock Doctrine@ where you shock somebody, by disorienting them, by getting them so they can't tell what's going on around them and they applied it to - capturing and interrogating prisoners. So, now - if you're going to capture a prisoner, you do it in the middle of the night, while they're half asleep, put a bag over their head. Maybe drug them up - take 'em away and then keep them confused and disoriented for weeks and months and after a while - they start co-operating. Of course who knows what you get - who knows how tainted the information is but this was the idea of the Shock Doctrine for torture. This was a way to get docile, co-operative prisoners.

Well Friedman took the idea and applied it to economics and that's where his idea, that the opportunities come in, during crisis - I'll read his line again Aonly a crisis - actual or perceived produces real change. When that crisis occurs, the actions that are taken depend on the ideas that are lying around@. When you have stuff lying around ready to throw in then you can make the changes. Friedman had his ideas of the Shock Doctrine laying around? What are the ideas that progressives and liberals have lying around? What are the ideas that people who believe in democracy and equal justice for all - a healthy environment - What laying around ideas do they have? Because we should have them.

We should have them inscribed in stone. And...there are a lot of ideas that we have values for. We want a healthy environment. We want equal treatment for everyone. We want healthcare for everyone. Just like the rest of the developed world has. Why don't we have it? - because we can't afford it. Hey - we can suddenly afford $700 billion to bail out and it's bailing out - it's still bailing them out. You can call it investing in them, you can call it saving the loans - is bailing them out - these companies that were profligate - that gambled - that engaged in highly risky behavior that failed. and now what are we doing - we are facing a situation where the average American has lost $30,000 $40,000 in savings. $9 trillion dollars disappeared. $9 trillion dollars disappeared from the stock market since the beginning of the year. This is Rob Kall -- Bottom-Up radio...

"Rob- we have a caller -- we have Jay..."

Kall: Hi Jay -- where you from? -- Hello -- Where you from Jay?

Jay: Can you hear me?

Kall: yes I can -- where are you from?

Jay: Texas Rob, I’m one of your editors Rob -- this is Jay Farrington

Kall: Oh hi Jay -- good to have you, what’s your question or comment?

Jay: well -- you know me...I forgot it while I was trying to get called in but there are plenty of others...

Kall: well, come along quickly then..heh heh heh

Jay: the Bottom-Up thing about economics -- including -- I think. You know you had a program where a man said if a corporation’s too big to fail -- it’s too big?

Kall: that’s senator Bernie Sanders, that’s right

Jay: Yeah

Kall: and they’re trying...what Naomi Klein said in her -- her talk to the University of Chicago was they’re trying to make them that big. It’s an intentional thing that they’re making them so big -- they’re merging them together so they’re so big, that they can’t fail.

Jay: It’s like it was back in the day there -- the robber barons -- Tammany Ring and all that...

Kall: how’s that?

Jay: the Anti-Trust movement

Kall: the anti what movement?

Jay: is there a possibility that our economy could go the other way, like Schumacher -- small is beautiful -- to de-centralize -- isn’t centralization one of the big problems?

Kall: I -- I agree, I think this is the Bottom Up approach that Bill Clinton and Obama talked about -- you know I’ve been writing about it.. we’re not going to have a stronger healthier economy by consolidating all the banking -- energy -- all the banking resources into a handful of companies that -- you know Japan has three banks -- that’s it! We’ve got to do the opposite -- We should be lending -- we should be investing in ten thousand banks and helping all the ones that, that did well -- not all these incompetent failure banks -- we should be rewarding the banks that did a good job -- that didn’t get in trouble and we should go to them and say show us your bottom line. The better you’ve done, the more we’ll invest in you...and we should let them manage these failed banks - these giant banks -- Goldman Sacks, Morgan Stanley, and Bank of America and Western Union -- they’re all in trouble, they’re all in big trouble -- why, because they took risks they shouldn’t have taken. Because they took -- they approached the economy with exotic derivatives and all kinds of crazy stuff built on top of ideas -- of theories and constructs instead of just basic business.

Jay: OK one more question Rob and then I’ll get off

Kall: Shoot

Jay: and the question is...now that we’ve found out that congress doesn’t have to listen to the will of the people, very clearly during this crisis -- they went ahead and did what they were told by someone -- uhh what is the peoples recourse now -- what -- uhh now what? Wait for the election and hope they make things different?

Kall: I’ve been thinking a lot about this -- uhh -- I -- there are a lot of people on Op-Ed news.com that -- that say the answer is -- to vote for a 3rd party candidate, to don’t vote at all -- I really believe that you’ve got to make a choice among the two primary candidates now and then we’ve got to do everything we can to get rid of the ones who didn’t do their job or over the next two years don’t come around. I think - You know -- we’ve been told that -- there were threats of -- uhh - ...that there would be a military take-over -- if this - if this didn’t go through -- this $700 Billion dollar bail-out, and I don’t doubt that there were -- that people were told that. Uhh, you know there’s that video that Naomi Wolf did that

Jay: ...forward and say that I was threatened there -- in fact it would probably be that we just had a conversation that’s all -- you know...but they know they were threatened and it’s gotten out, but is there anybody that’s standing up and saying that publicly?

Kall: well one or two... Uhh, I spoke with my congressman over the weekend you know and he said that he was not happy with the -- uhh - the way things were originally, even though he voted for it the first time around, but the second time he said he felt better because it did have some protections in there and what-have you, but Naomi Klein just made it really clear that what’s been passed so far is no good and needs to be fixed -- I can’t believe that in England, Gordon Brown got 12% interest and Hank Paulson only took 5%, why couldn’t he have done the same thing?...Meanwhile we’re coming up on the end of the hour -- Jay are we going to get this transcribed you think?

Jay: Ha, ha, oh boy, I stepped into that one!

Kall: Heh heh heh -- Jay’s been wonderful -- he’s been really helping...OK thanks Jay good to talk to you.

Stumble It!

Stumble It!