G20 meeting like 1933 -- breakdown of capitalism

Harper misses G20 group photo, allegedly 'in the loo' .. Oh, Canada.

The so-called "family photo" is a common affair at these summits, and in this case some of the people in the frame aren't even members of the 20, there are 29 leaders up there (including unelected people such as IMF Managing Director Dominique Strauss-Kahn and World Bank President Robert Zoellick). Canada's Prime Minister, Stephen Harper, is not on the stage. Reports are that he just flat out missed it. He was supposed to be standing next to Angela Merkel (red jacket, second row).

Apparently, either no one noticed, or they couldn't wait. Ouch.

G20 leaders: (First row, left to right) South Korean President Lee Myung-Bak, French President Nicolas Sarkozy, Saudi Foreign Minister Prince Saud al-Faisal, Chinese President Hu Jintao, British Prime Minister Gordon Brown, Brazilian President Lula Ignacio de Silva, Indonesian President Susilo Bambang Yudhoyono, Mexican President Felipe Calderon, and Argentine President Cristina Fernandez de Kirchner. (Second row, left to right) President of the European Commission Manuel Barroso, Indian Prime Minister Manmohan Singh, Turkish President Recep Tayyip Erdogan, US President Barack Obama, Russian President Dmitry Medvedev, South African President Kgalema Motlanthe, Dutch Prime Minister Jan Peter Balkenende, Spanish Prime Minister Jose Luis Rodriguez Zapatero, and German Chancellor Angela Merkel. (Third row, left to right) International Monetary Fund Managing Director Dominique Strauss-Kahn, UN Secretary General Ban Ki-moon, World Trade Organization Director General Pascal Lamy, Thai Prime Minister and chair of the Association of Southeast Asian Nations (ASEAN) Abhisit Vejjajiva, Italian Prime Minister Silvio Berlusconi, New Partnership for Africa’s Development (NEPAD) Meles Zenawi, Australian Prime Minister Kevin Rudd, Japanese Prime Minister Taro Aso, Czech Prime Minister and President of the European Council Mirek Topolanek, Governor of the Bank of Italy Mario Draghi, and World Bank President Robert Zoellick.

The G20 summit concluded Thursday having failed to adopt the principal demands of either the US and Britain, which came to the London gathering advocating coordinated global fiscal stimulus, or a European bloc led by Germany and France, which called for international regulation of major financial institutions.

Instead, the two sides papered over their differences with a nine-page communiqué, much of which consisted of high-flown phrases such as the affirmation that all the assembled heads of state "agreed on the desirability of a new global consensus on the key values and principles that will promote sustainable economic activity."

There was also the claim—echoed by virtually all of the media—that the summit had agreed to "an additional $1.1 trillion programme of support to restore credit, growth and jobs in the world economy."

The Financial Times of London carried one of the few reports that treated this pledge with the skepticism it deserved. "The failure of the G20 summit was too painful for world leaders to contemplate and [British Prime Minister Gordon] Brown ended the meeting with a blizzard of large numbers to disguise the fact that leaders had not agreed to a further additional fiscal stimulus as Mr. Obama and Mr. Brown had wanted."

The newspaper also noted, "Much of the $1,100 billion pledged to help the world recover from recession represented existing commitments or pledges of future funds that had not been pinned down."

The communiqué claimed that the assembled governments would boost the International Monetary Fund's existing resources by $500 billion to aid so-called "emerging market" countries. According to initial reports, where this money is to come from is by no means clear.

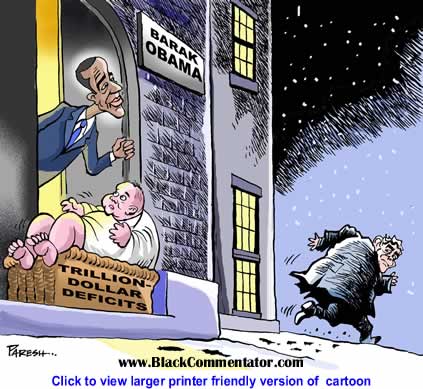

Japan has reportedly pledged $100 billion; the European Union $100 billion and China about $40 billion. In his post-summit press conference, US President Barack Obama gave no indication that Washington is planning to come up with a similar amount of money, mentioning instead that he planned to ask Congress to approve a paltry $448 million to aid "vulnerable populations—from Africa to Latin America."

From bitter experience, the oppressed countries know that such pledges often fail to materialize. The chairman of the Commission of the African Union, Jean Ping, told the BBC as the summit was in progress that he would be making the case for a sell-off of the IMF's gold reserves to provide money for Africa. "We are not asking countries to put their hands in their pockets and give us money because they've promised, promised, promised and done nothing," he said.

In one of the few substantive points in the agreement, the G20 decided to allow the IMF to create $250 billion in Special Drawing Rights, its own synthetic currency based on the dollar, the euro, the yen and the British pound sterling. The aim is to boost countries' foreign reserves, with the lion's share going to the wealthiest nations.

In summing up the agreement, British Prime Minister Brown said that the governments agreed on the IMF spending another $250 billion over two years in an effort to counter the collapse in global trade. As the Financial Times noted, "up-front contributions from G20 countries were only $3bn to $4bn, an annex to the communiqué said."

Even if the much-touted $1.1 trillion package were genuine—which it is not—it would be the equivalent of putting a Band-Aid on a gaping chest wound. Over the past year, the meltdown of international stock markets, the fall in commodity prices and the collapse in real estate values have wiped out an estimated $50 trillion in wealth. Moreover, the US government and the Federal Reserve alone have spent, lent or committed $12.8 trillion to bail out the US banks, with no discernable effect in terms of stemming the rising tide of job losses.

Brown highlighted other points in the G20 agreement which, again, were more appearance than substance.

One measure, which only underscored the failure of the French and German governments to achieve their goal of international regulation of financial institutions, consisted of turning the existing Financial Security Forum into the Financial Stability Board. The main change, outside of the name alteration, would be the addition of members of the G20 not currently represented, including China, India and Brazil. However, it remains a toothless watchdog, with no power to impose sanctions on private banks and finance houses whose practices are deemed to be endangering the world economy.

French President Nicolas Sarkozy praised Obama and Brown at the conclusion of the summit, while claiming authorship of what he proclaimed the greatest financial reform since Bretton Woods. "Of course, there are tensions, wrestling matches and vested interests, but even our Anglo-Saxon friends are convinced we need reasonable rules," he said.

In reality, the US rejected any international regulation of its banking system. The G20 leaders' statement instead declared, "We each agree to ensure our domestic regulatory systems are strong."

Another question, the disposal of toxic assets that have paralyzed the financial system, was raised in the communiqué only from the standpoint of a vague pledge that the individual G20 states would each, separately, "take all necessary action to restore the flow of credit."

The G20 leaders also renewed a solemn pledge not to engage in protectionism. According to the World Bank, since they last took this oath in November, 17 out of the 20 countries have adopted new protectionist measures.

It was widely reported that the assembled heads of state had agreed to a resolute "crackdown" on the obscene levels of pay and bonuses for bankers. The British Daily Telegraph reported Thursday that an agreement had been reached to "ensure compensation structures are consistent with firms' long-term goals and prudent risk-taking."

In a press conference after the summit, US President Obama made it clear that there is no intention to actually enforce international standards limiting the hundreds of millions of dollars earned by Wall Street executives. "It doesn't mean the state micromanaging," he said. "It doesn't mean that we want the state dictating salaries; we don't. We—I strongly believe in a free-market system, and as I—as I think people understand in America, at least, people don't resent the rich; they want to be rich. And that's good."

It was Obama and Brown who made the most grandiose claims for the London summit. Obama called it "a turning point in our pursuit of global economic recovery." For his part, Brown claimed that the G20 meeting signified that "a new world order is emerging with the foundation of a new progressive era of international cooperation."

This is all nonsense. Even as the summit took place, the reality of spiraling levels of unemployment made itself felt. In the US, it was reported that another 742,000 jobs were wiped out last month. In Spain, the Labor Ministry announced that the unemployment rate had hit 15.5 percent, the worst in Europe, with 3.6 million Spanish workers jobless. In Britain itself, the site of the summit, new rounds of mass layoffs were announced, with two companies, insurance giant Norwich Union and aircraft manufacturer Bombardier, slashing 2,500 more jobs.

This global destruction of jobs will continue and intensify, threatening hundreds of millions of people with poverty and hunger. The World Bank has issued a new forecast predicting a global economic contraction of 1.7 percent. World Bank President Robert Zoellick told the BBC, "We haven't seen numbers like that since World War II—that really means the Great Depression."

He warned, "We believe that the lower growth will lead to some 200,000 to 400,000 babies dying this year. So the overall effects are dramatic."

United Nations Secretary General Ban Ki-moon was more explicit still in detailing the extent of the present crisis and its implications. He told the Guardian, "We have seen the frightening velocity of change. What began as a financial crisis has become a global economic crisis. I fear worse to come: a full-blown political crisis defined by growing social unrest, weakened governments and angry publics who have lost all faith in their leaders and their own future."

He continued, "In good times, economic and social development comes slowly. In bad times, things fall apart alarmingly fast. It is a short step from hunger to starvation, from disease to death, from peace and stability to conflict and wars that spill across borders and affect us all, near and far. Unless we can build a worldwide recovery we face a looming catastrophe in human development."

As for the claim that the summit signaled the emergence of a "new world order" based on international cooperation, the reality is that the summit only confirmed the collapse of the old world order, established in the aftermath of World War II and based on the unchallenged economic and financial supremacy of the US capitalism and a dollar-based world monetary system.

The US, once the engine of world growth, is now the world's leading debtor nation, and its financial crisis, the product of decades of deterioration of its productive forces and the turn towards ever more parasitical and criminal forms of speculation, has become the engine of a deepening worldwide depression.

Obama would have suffered greater humiliation still had it not been for China. But this dependency on Beijing only highlights the extraordinary economic and political decline of US imperialism.

Commenting in the Financial Times on the pre-summit meeting between Obama and President Hu Jintao, where China agreed to provide funds for the IMF, Geoff Dyer wrote that talk of an emerging G2 "does reflect the reality that on a growing range of international issues, little can happen without agreement between the US and China."

He noted that China has also launched a series of initiatives "which demonstrates a desire to move centre-stage," including the demand last week by the Chinese central bank president, Zhou Xiaochuan, "for the eventual replacement of the US dollar as the global reserve currency." China has mooted that the replacement for the dollar should be the IMF's Special Drawing Rights.

Such an open challenge to the global supremacy of the dollar and its role as the reserve currency threatens the economic viability of the US, which is entirely dependent on other nations purchasing dollars to service its debts. But China's demand has also been taken up by Russia, with Prime Minister Vladimir Putin and President Dmitry Medvedev urging the ruble's adoption as a regional reserve currency and the creation of a new global reserve currency to be issued by international institutions.

Obama said of the summit that those who identified the major disagreements and conflicts between the various partners had "confused open and honest debate with irreconcilable differences."

In reality, inter-imperialist antagonisms were manifest throughout the summit and will inevitably sharpen as the economic crisis worsens. Far from having laid down a globally coordinated program to rescue world capitalism, the London summit has only demonstrated the irreconcilable contradiction between the globally integrated economy and the capitalist nation state system, and the impossibility of the rival national states adopting a genuinely international approach to the crisis. In the end, the London summit and its various palliatives will come to be seen in much the same light as the London summit of 1933, another milestone in the worldwide breakdown of capitalism.

The historic blueprint outlines key measures of the $1tr deal

By Edmund Conway

Friday April 03 2009

British Prime Minister Gordon Brown hailed yesterday's G20 agreement as a "historic" moment that would help lift the world out of recession earlier than predicted.

World leaders agreed on a blueprint for reining in the excesses that fed the worst financial crisis in six decades and pledged more than $1trn in emergency aid to cushion the economic fallout.

The G20 policy makers called for stricter limits on hedge funds, executive pay, credit-rating companies and risk-taking by banks.They also boosted the resources of the International Monetary Fund (IMF) and offered cash to revive trade to help governments weather the economic and social turmoil.

IMF resources

The centrepiece of the announcement was a dramatic increase in the funding available to the International Monetary Fund.

The IMF currently has about $250bn at its disposal to lend to countries facing financial difficulty. Several Eastern European countries have already sought assistance.

Under the G20 agreement, funding for the IMF will be increased to $750bn. Japan agreed to provide $100bn of the extra funding, the European Union $100bn and China about $40bn.

Bankers' pay

Unprecedented restrictions on pay and bonuses for bankers was agreed by the world leaders.

A new international set of rules will prohibit banks from paying traders and executives multi-million cash bonuses if they are making risky decisions. Regulators will assess how much risk traders are taking and those deemed to be making more risky decisions will only be paid in shares which cannot be sold for several years.

Quantitative easing

The IMF will increase the amount each country has in so-called special drawing rights (SDR) by $250bn.

This is effectively global quantitative easing -- comparable to the measures carried out by the Bank of England last month when it committed to pumping £75bn into the British economy.

This is a form of printing paper money. The amount available under SDR was increased more than ten-fold yesterday.

Fiscal stimulus

This was supposed to be the big centrepiece of the G20 summit -- a global agreement on how much countries around the world would spend on measures to stimulate their economies and fight unemployment.

However, the French and German governments ruled out an explicit commitment. All leaders could agree to announce was how much had already been pledged -- $5trn.

The British Prime Minister hailed a statement that governments would not rule out further bailouts in future if required.

Offshore tax havens

Countries refusing to pass information to foreign tax authorities to help catch potential tax evaders will face sanctions in future. A preliminary list of such offshore tax havens is to be published. Mr Brown said it was "the beginning of the end" for widespread tax avoidance.

Toxic Assets

Most economists agree that until the world's leading nations cleanse the balance sheets of their stricken banks, the credit crunch will persist and there will be no return to normal lending conditions.

The G20 communique recognises this issue and pledges that each country will dispose of the assets, either by setting up a so-called bad bank or by insuring the assets against default. The commitment is slightly stronger than in previous international statements.

Protectionism

The G20 member countries committed to a 12-month freeze on introducing any new trade barriers, tariffs or quotas.

If followed to the letter, this would be a significant move. It was an increase in protectionism during the 1930s that lengthened and deepened the Great Depression, and ultimately fed the forces that caused World War Two.

Financial monitoring

The summit agreed to turn the Financial Stability Forum (an international group of regulators) into a more pro-active global banking watchdog. It will be renamed the Financial Stability Board (FSB) and its membership will be broadened to take in developing economies, including China, Brazil and India.

Trade finance

G20 leaders agreed to provide $250bn in new trade credit guarantees to facilitate global trade. The guarantees -- to be offered by the World Bank and other institutions -- should allow exporters to obtain credit again.

Federalnaya Sluzhba Bezopasnosti ...

Russian abbreviation for the Federal Security Service of the Russian Federation the successor to the KGB.

Stumble It!

Stumble It!

0 Comments:

Post a Comment

<< Home